Are You Eligible for the Electric Vehicle Tax Credit? Key Facts You Need to Know in 2025

Introduction

As the world accelerates toward sustainable transportation, electric vehicles (EVs) have become increasingly popular. In 2025, understanding the financial incentives available, particularly the federal EV tax credit, is crucial for prospective buyers. This comprehensive guide will delve into the key aspects of the 2025 EV tax credit, helping you determine your eligibility and maximize potential savings.

Understanding the 2025 EV Tax Credit

The federal electric vehicle tax credit in 2025 is a financial incentive offered to encourage the purchase of clean, energy-efficient vehicles. The maximum amount available under the EV tax credit is $7,500, though the actual amount depends on specific factors like the vehicle’s battery capacity, manufacturing requirements, and the buyer's eligibility. The Inflation Reduction Act, which was passed to support green energy and carbon emission reductions, has extended and modified the existing tax credit program. These changes include an increase in the focus on U.S.-sourced materials, which means that to qualify for the full $7,500, an EV must meet certain criteria about the sourcing of its battery components and critical minerals. The act also emphasizes supporting domestic manufacturing, ensuring that vehicles assembled in North America are prioritized. Along with the $7,500 credit for new EVs, the law also introduced a $4,000 credit for used EVs, making these incentives more accessible to a broader group of buyers. Moreover, specific vehicle models and types may not be eligible if they do not meet the stringent requirements set by the federal government, so understanding how the tax credit applies to your desired vehicle is essential. These credits are part of a broader initiative to reduce emissions and make electric cars more affordable and mainstream in the automotive market.

Eligibility Criteria for EV Buyers

To qualify for the federal EV tax credit in 2025, both the vehicle and the purchaser must meet specific criteria:

1.Vehicle Requirements:

- Final Assembly: The vehicle must undergo final assembly in North America.

- Battery Components: A certain percentage of the vehicle's battery components must be sourced from the United States or its free-trade partners.

- Critical Minerals: The vehicle's battery must contain a specified percentage of critical minerals extracted or processed in the U.S. or countries with free-trade agreements.

2.Purchaser Requirements:

- Income Limits: There are adjusted gross income (AGI) caps for individuals and households to qualify for the credit.

- Tax Liability: The credit is non-refundable, meaning it can only reduce your tax liability to zero; any remaining credit cannot be refunded.

It's essential to consult the latest IRS guidelines or a tax professional to confirm current eligibility requirements, as they are subject to change.

How Much Can You Claim?

The amount you can claim as part of the EV tax credit depends on several factors, but the maximum credit for a new electric vehicle is $7,500. To qualify for the full $7,500 credit, the vehicle must meet certain requirements. This includes having a battery capacity of at least 7 kWh, being assembled in North America, and meeting the sourcing requirements for critical minerals and battery components. These stipulations ensure that the credit benefits both consumers and the domestic manufacturing industry. For qualifying used EVs, the credit is capped at $4,000 or 30% of the purchase price, whichever is lower. The used EV tax credit aims to make electric vehicles more affordable for a broader range of buyers, especially those who might not be able to afford a new model.

The amount you can claim will also depend on the size of the battery in the vehicle. Generally, vehicles with larger battery capacities may qualify for a higher portion of the credit. However, there are exceptions, and some vehicles may have additional requirements or limitations based on their battery size, MSRP, or manufacturing origin. Another important consideration is that the credit is non-refundable, meaning it can only reduce the amount of taxes you owe. If your tax liability is less than the amount of the credit, you will lose the remaining portion of the credit. This underscores the importance of ensuring that you can fully utilize the credit before committing to an EV purchase.

New vs. Used EV Tax Credits

In 2025, both new and used electric vehicles are eligible for federal tax credits, but the amounts and requirements differ. The tax credit for new EVs remains the most substantial, with up to $7,500 available, provided that the vehicle meets the assembly, battery sourcing, and price requirements. This credit is available for individuals purchasing new, unused EVs. In contrast, used EVs qualify for a smaller credit: up to $4,000 or 30% of the vehicle's purchase price, whichever is lower. This used EV tax credit is designed to make electric vehicles more accessible to individuals who might not have the budget for a new model.

There are additional requirements for used EVs to qualify for the credit. The vehicle must be at least two years old, and it must be purchased from a dealership (as opposed to a private sale). The buyer also must meet income eligibility requirements, and the price of the used EV must not exceed $25,000. These provisions make the used EV tax credit a more affordable option for people seeking an electric vehicle but who are limited by budget constraints. The used EV tax credit has been specifically designed to appeal to a wider array of potential buyers, including those who cannot afford new cars or who prefer the cost savings associated with buying a pre-owned vehicle. This is a significant shift from earlier EV tax credit offerings, which were only available for new vehicles.

State and Local EV Incentives

In addition to the federal EV tax credit, many states and local governments provide additional incentives to encourage the adoption of electric vehicles. These incentives can significantly lower the cost of purchasing an EV, and they vary greatly depending on the state and locality. Some states, such as California and New York, offer rebates or tax credits for electric vehicle purchases, reducing the upfront cost for buyers. Others may provide additional benefits, such as sales tax exemptions, reduced registration fees, or access to carpool lanes.

For example, in California, buyers of new or used electric vehicles can receive a rebate from the state’s Clean Vehicle Rebate Project (CVRP), in addition to the federal tax credit. Similarly, New York offers incentives like rebates and incentives through the Drive Clean Rebate Program. Local governments and utility companies may also offer incentives such as rebates for installing home charging stations or discounted electricity rates for EV owners during off-peak hours. It’s crucial to check with your state and local agencies for specific programs available in your area, as these incentives can change frequently. These local and state incentives, when combined with the federal tax credit, can lead to significant savings on the total cost of purchasing an electric vehicle.

How to Claim the EV Tax Credit

Claiming the EV tax credit is a relatively straightforward process, but it requires careful attention to detail to ensure that you meet all the eligibility requirements. The first step is to purchase a qualifying electric vehicle, either new or used, that meets the necessary criteria set by the federal government. Once you have made the purchase, you need to ensure that you receive a certification from the manufacturer or dealer confirming that the vehicle qualifies for the credit. This certification is important for your tax filing process.

Next, you will need to complete IRS Form 8936, which is the form used to claim the electric vehicle tax credit. This form must be submitted along with your annual tax return. Form 8936 will ask for specific details about the vehicle, including its make, model, and VIN, as well as proof of purchase. Once the form is submitted and your tax return is processed, the credit will be applied to reduce your tax liability. Remember, the credit is non-refundable, so it can only reduce the amount of taxes you owe. If you owe less than the full credit amount, you will not receive the difference back. Make sure to consult with a tax professional if you have any questions about claiming the credit, as the process can sometimes be complicated, especially when dealing with multiple incentives.

Potential Challenges and Limitations

While the EV tax credit offers substantial savings, potential challenges include:

- Manufacturer Caps: Previously, credits phased out after manufacturers sold 200,000 qualifying vehicles. However, recent legislation has removed this cap, making more vehicles eligible.

- Income Limits: High-income earners may not qualify due to AGI caps.

- Non-Refundable Credit: The credit cannot exceed your tax liability; unused portions do not roll over.

Staying informed about these limitations is crucial when planning your EV purchase.

Frequently Asked Questions (FAQs)

Q1: Can I claim the EV tax credit if I lease an electric vehicle?

A: Typically, the leasing company claims the credit and may pass on savings through reduced lease payments.

Q2: Are plug-in hybrids eligible for the EV tax credit?

A: Yes, if they meet battery capacity and other eligibility requirements.

Q3: Do state incentives stack with federal tax credits?

A: Yes, you can combine state and federal incentives, maximizing your savings.

Q4: How do I know if a specific EV model qualifies for the tax credit?

A: Consult the IRS or the Department of Energy's list of eligible vehicles, as qualifications can change.

Q5: Is the EV tax credit available for business purchases?

A: Yes, businesses can claim credits for qualifying vehicles used for business purposes.

Conclusion

The electric vehicle tax credit in 2025 provides a substantial financial incentive for those looking to purchase an electric vehicle. Whether you’re considering a new or used EV, understanding the eligibility requirements, credit amounts, and the claiming process is crucial for maximizing the benefits. The federal credit, combined with state and local incentives, can make switching to an electric vehicle much more affordable and accessible. As the electric vehicle market continues to grow and evolve, keeping up with the latest tax incentives and requirements will ensure you make the most of available savings. By following the guidelines and taking advantage of the incentives, you can contribute to a greener future while saving money on your next vehicle purchase.

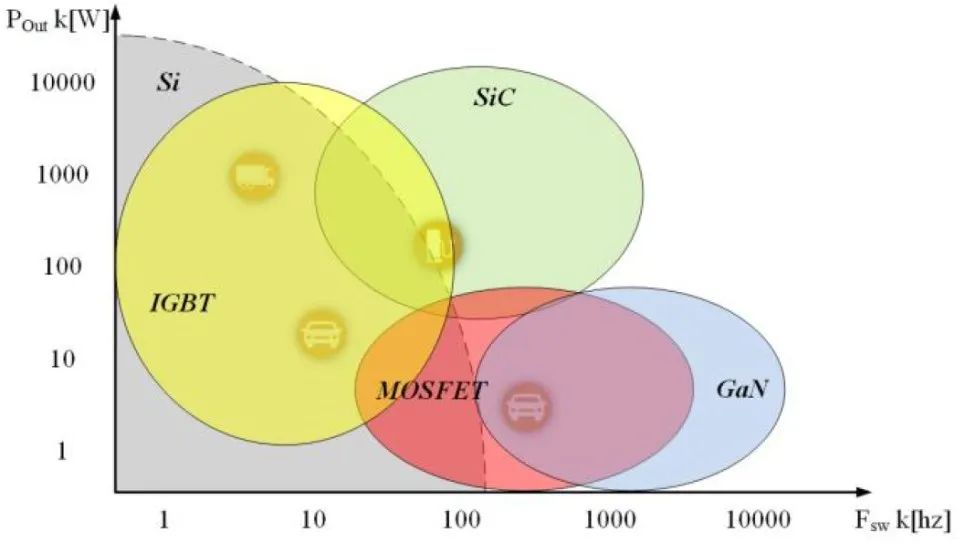

Read More: Which is Better: EV Hub Motor or PMSM Motor for Electric Vehicles?